- BUY TURBOTAX DELUXE WITH STATE ONLINE HOW TO

- BUY TURBOTAX DELUXE WITH STATE ONLINE SOFTWARE

- BUY TURBOTAX DELUXE WITH STATE ONLINE FREE

BUY TURBOTAX DELUXE WITH STATE ONLINE FREE

BUY TURBOTAX DELUXE WITH STATE ONLINE SOFTWARE

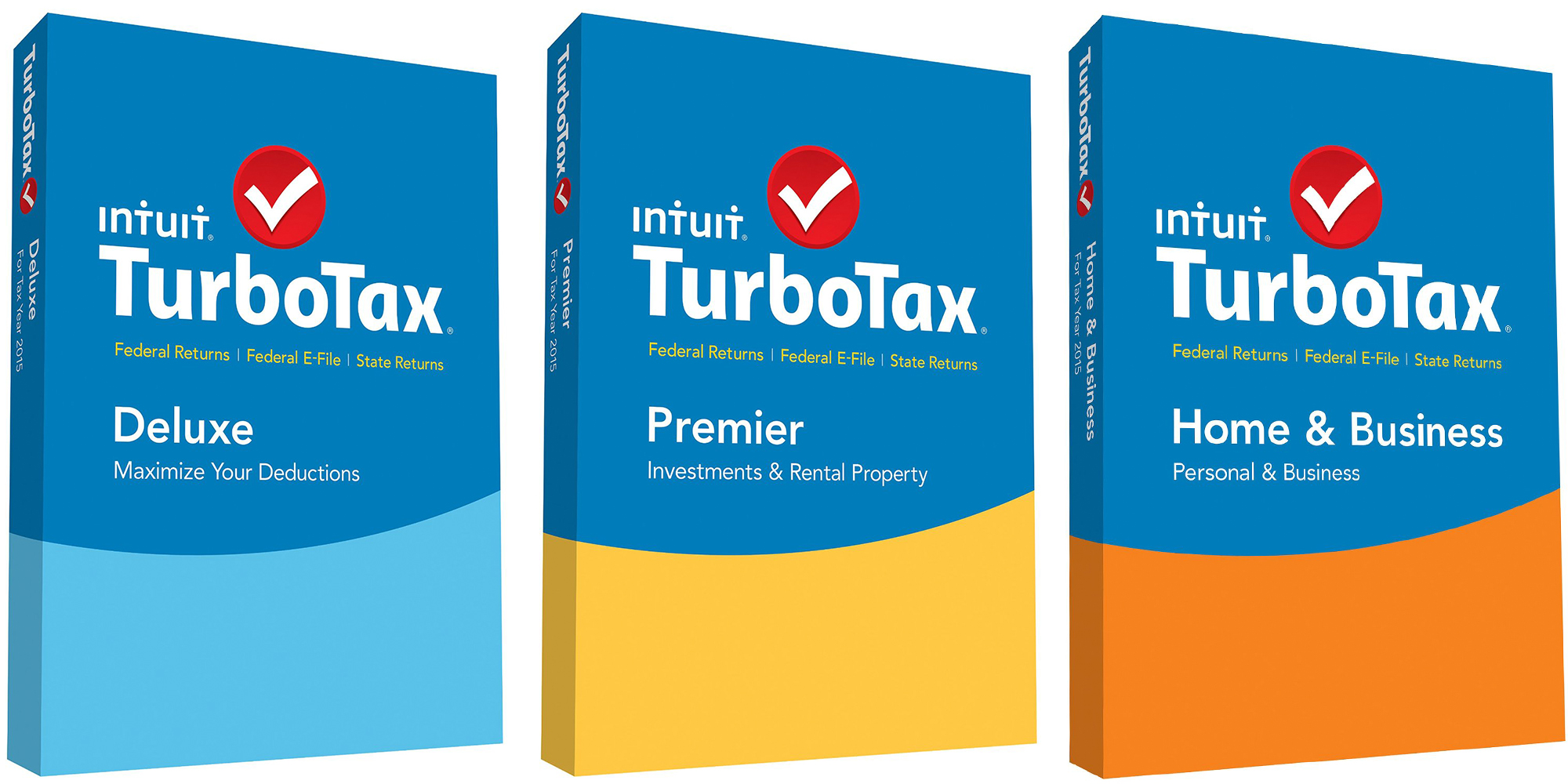

H&R Block is the tax software that gives you more free features than TurboTax. You can get live chat support with the add-on Deluxe plan, though. Verdict: FreeTaxUSA offers more features than the free version of TurboTax. Import your returns from another software, easily and free.FreeTaxUSA supports 350+ deductions and credits and even gives audit assistance at minimal costs.

If we look at FreeTaxUSA, it lets you file for your federal taxes at absolutely no cost, while you have to pay $14.99 for a state return. Stock sales, rental property income, and many more situations are not covered in the free version. But that’s only possible if you have to file a simple tax return. The TurboTax free edition lets you file for your federal and state taxes at $0 costs, with easy and quick steps. The most trustworthy (free from frauds) tax filing option.ĭetailed reviews about the alternatives to TurboTax: #1) FreeTaxUSAīest for bringing up a nice range of features at minimal or no charges at all.īoth TurboTax and FreeTaxUSA offer a free version. Tax preparation training and in-person assistance features. $0 to $89.95 (plus additional fees for state tax filing). Tax preparation training and easy to use tax filing features. One free state and one free federal filing Price plans start from $24.95 to $54.95 (additional fees for state taxes). $0 for federal returns, $14.99 for state returnįree version has more features than TurboTax.Įxpert assistance with the premium and the higher price plans You should keep that in mind that the total of all deductions should be more than 2% of your AGI (Adjusted Gross Income).Īnswer: An accountant can minimize much of your tax-related worries and can even give you helpful tips through which you can maximize your tax deductions.īut there are many software out there today that offer expert advice, while filing for taxes, at costs that are much lower than the cost of hiring an accountant.īrings up a nice range of features at minimal or no charges at all. Q #5) Can I write off the cost of tax software?Īnswer: Yes, the cost of tax software can be deducted through the miscellaneous itemized deductions. Suggested Reading => Compare the best Crypto Tax Software Most of the tax software offers free tax filing for simple taxes.Īpart from this, with the help of tax software, like H&R Block, TaxAct, and many more, you can take help from a tax expert for filing the taxes, or even hand over your taxes to an expert at TurboTax. Q #4) Can I use tax software to complete my income tax returns?Īnswer: Yes, in fact, tax software can be extremely helpful in completing your income tax returns. Plus, there is a Deluxe plan priced at $6.99, that offers you priority support, unlimited amendments after submitting returns, and audit assistance. Some of these, (like TurboTax) offer only simple tax filing while others give some options for deductions too.Īnswer: Filing for federal returns is free with FreeTaxUSA. Some of them are TurboTax, FreeTaxUSA, H&R Block, TaxAct, TaxSlayer, Credit Karma Tax, and the official website of the IRS.

On the other hand, with TurboTax, you can file with the help of a tax expert at prices ranging from $80 to $200. Thus, TurboTax seems to be the winner in the battle of TurboTax vs accountant.Īnswer: There are tax software out there that offer free filing for federal as well as state taxes. According to Investopedia, the average cost of getting an itemized form 1040 and a state tax return through a CPA is $273. Facts Check: According to a report by Markets and Markets, the global tax management market is projected to expand from $15.5 billion in 2019 to $27 billion by 2024 while growing at a CAGR (Compound Annual Growth Rate) of 11.7% during this period (2019 to 2024).Īnswer: If we compare TurboTax vs CPA (Certified Public Accountant), we will find that a CPA can cost you much higher than the expert-assisted filing with TurboTax.

0 kommentar(er)

0 kommentar(er)